Akhuwat Foundation: Loan Eligibility Criteria

Akhuwat Foundation is a leading Islamic microfinance institution in the country that provides completely interest-free loans to empower individuals and promote economic development in the country. Applicants must meet these specific criteria. fulfill this Akhuwat Loan Eligibility criterion to get a free loan in 2025.

- Original CNIC: The aspirants applying for the loan must have a national identity card.

- Age Limits: Applicant should be between 18 and 60 years of age and have an entrepreneurial spirit.

- Ability to run Business: Applicants should know about business activities and should be able to use the funds they will receive in a good way and have the ability to run the business.

- Clean Criminal Record: The applicant should not be involved in any criminal activities, and his identity card should be completely free of criminal activities.

- Good Community: Akhuwat Foundation always emphasizes good social and moral character. Applicants must have a good reputation in their society.

- Grandnator: To get a loan from the Akhuwat Foundation, you have to provide two guarantors who are not family members; they can be local dignitaries.

Because the Akhuwat Foundation works in every city and every region of Pakistan, however, the eligibility criteria may be different depending on the selection of each branch for the loan. Here is some important information that will be beneficial for you.

Akhuwat Foundation Mission

Akhuwat Foundation is uniquely designed to deliver financial assistance to those in need through community engagement, emphasizing transparency and accountability, and fostering a supportive environment where borrowers can thrive and communities thrive.

Entrepreneurs can add themselves to the list. The foundation’s impact on poverty alleviation in Pakistan is a testament to the power of interest-free microfinance and the spirit of brotherhood that drives this mission.

Through its continuous efforts, Akhuwat is not only providing loans, but it is also building a bright future for countless individuals and families whose efforts are always appreciated all over Pakistan and depend on it. Attributed to Dr. Amjad Saqib.

Akhuwat Foundation Loan Scheme 2025 Apply Online

In this era of inflation, Akhuwat Foundation is offering loans in very easy installments of only 8334 rupees per month. Loans from 1 lakh to 50,00,000 are being given without any guarantee and interest. loan of Rs. 1 lakh with a repayment period of one year, a loan of Rs. 5 lakh with a repayment period of 5 years, and a loan of Rs. 10 lakh with a repayment period of 10 years. Check your Akhuwat Loan Eligibility to apply online for the Akhuwat new scheme.

These best offers from the Akhuwat Foundation are available for a limited time now. So contact the Akhuwat Helpline now and avail this wonderful opportunity. Akhuwat Foundation Loan Scheme is being provided completely interest-free as per Islamic Laws. Are you looking to start a business or build a new home? Apply online for a loan of Rs 50,000 to Rs 50 Lakh in just half an hour.

This can be done and will be transferred to your account at home. Especially for new businesses, loans are being provided without any collateral. The monthly installment will be only 8334 rupees. Now, you only have to send an SMS to the WhatsApp helpline number; this loan amount will be provided immediately, so there is no need to delay; send your original ID card photo to the Akhuwat Foundation team and get the loan at home.

There is no age classification in this new loan scheme. Both men and women can apply for this scheme regardless of how much they take the loan; the monthly installment will be only 8334.

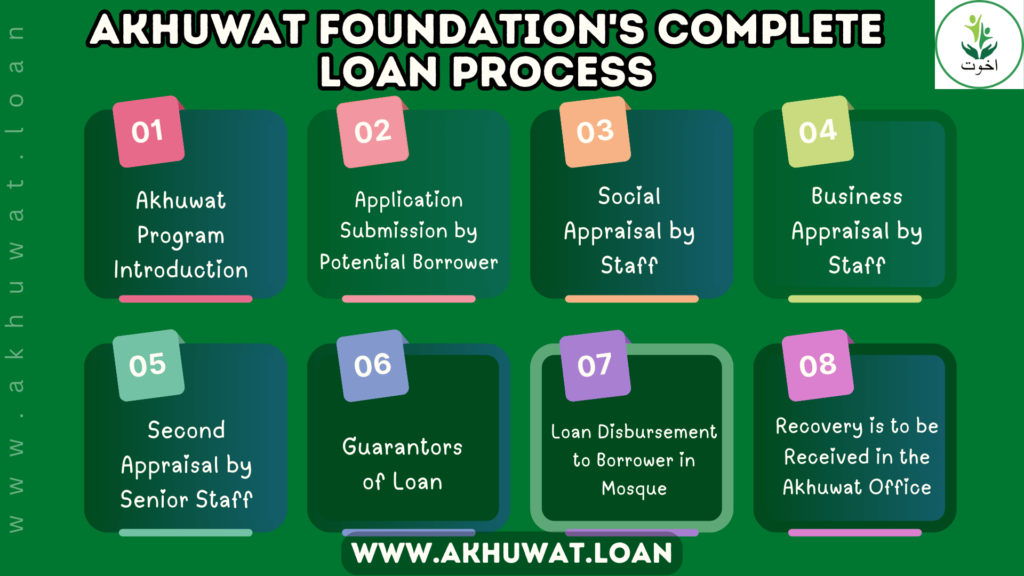

The Akhuwat Foundation’s Complete Loan Process

1. Akhuwat Program Introduction

Akhuwat Foundation’s lending program is a cause of development for the most marginalized communities by providing interest-free loans to people through self-employment and promoting entrepreneurship. To promote.

2. Application Submission by Potential Borrower

Borrowers submit forms and necessary documents, including business plans and financial statements. The process is designed to be straightforward and inclusive, ensuring accessibility for all. Emphasizes the distribution of.

3. Social Appraisal by Staff

Fraternity staff may conduct a social assessment at any time to assess an applicant’s background and financial situation. Applicants must verify their community to ensure need and credibility.

4. Business Appraisal by Staff

Akhuwat Foundation Business Appraisal Akhuwat staff will review financial projections and market conditions to ensure the loan will be used efficiently while evaluating the sustainability of the applicant’s business plan.

5. Second Appraisal by Senior Staff

Senior staff conducts a second verification to review and validate the initial results. Additional checks help ensure accuracy and fairness in the loan process. Their recommendation is made based on a thorough analysis of the applicant’s needs and business viability.

6. Guarantors of Loan

Applicants must provide guarantors who will vouch for their creditworthiness and financial responsibility. The Brotherhood assesses the guarantors’ stability to ensure they can meet their obligations when required. The move adds security to the loan process.

7. Loan Approval by Loan Approval Committee

The loan sanctioning committee reviews the guarantors to make the final decisions. This process ensures full and fair distribution of loans to the most deserving candidates and maintains transparency.

8. Loan Disbursement to Borrower in Mosque

Loans are disbursed in local mosques, transparency and community support are strengthened, and borrowers are informed about the individual terms and repayment system in this event, which promotes responsibility and ethical values.

9. Recovery is to be Received in the Akhuwat Office

Borrowers pay their installments regularly at the fraternity office, where staff monitor the progress. Borrowers who repay their loans on time are allowed the first repayment cycle.

10. Monitoring of the Borrower’s Business

Akhuwat Foundation regularly visits the borrowers’ businesses or any other need for which they borrow and visits them on time to ensure effective utilization of the loans. Constantly monitored and assured, these loans will contribute to sustainable economic growth and better livelihoods.

Top 10 FAQs About Akhuwat Loan Eligibility Criteria

1. What are the basic eligibility criteria for the Akhuwat Loan?

To qualify, you need to demonstrate financial need and have a specific purpose for the loan, like education, business, or medical expenses.

2. Is there an age requirement to apply for the Akhuwat Loan?

Yes, applicants must be at least 18 years old to be eligible for the loan.

3. Do I need to be a Pakistani citizen to apply?

Yes, only residents of Pakistan can apply for the Akhuwat Loan.

4. What types of income proof do I need to provide?

You should submit documents that verify your income, such as salary slips, bank statements, or business records.

5. Can I apply for a loan if I am unemployed?

Yes, you can apply if you have a viable plan to use the loan, even if you are currently unemployed.

6. Are there any restrictions on how I can use the loan?

Yes, the loan must be used for approved purposes, such as education, starting a business, or medical treatment.

7. Do I need a guarantor to qualify for the loan?

A guarantor may be required in some cases, especially for larger loan amounts or if your financial situation is unclear.

8. Can I apply for multiple loans from Akhuwat?

Yes, you can apply for more than one loan, but you must meet the eligibility criteria for each application.

9. How long does it take to find out if my application is approved?

The processing time can vary, but you should expect to receive a response within a few days to a week after submitting your application.

10. What should I do if my application is rejected?

If your application is rejected, you can contact Akhuwat for feedback and see if there’s a way to improve your eligibility for future applications.

Your articles are extremely helpful to me. Please provide more information!